SkyView® advises financial advisors seeking financing to propel your practice to the next level

SkyView® is focused exclusively on the investment banking and financing needs of independent and registered investment advisors. We provide financial advisors with guidance and capital for practice succession, acquisition, merger, debt restructuring and flexible working capital options from a team of experienced wealth management veterans. Your growth initiatives require customized financing solutions – we’re here to help.

SkyView provides sellers with immediate liquidity at attractive valuations and buyers with capital to fuel your growth initiatives.

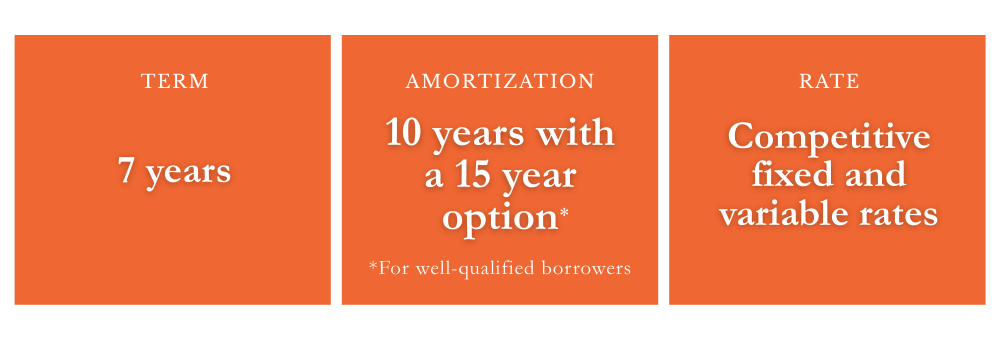

SkyView’s standard conventional loan structure*

SkyView secures conventional bank financing for financial advisor loans rather than SBA loans required for industries and applicants with less financial veracity. Average loan terms include the following:

* This does not constitute a commitment to lend. The fee, rate, terms, and conditions are for informational purposes only and will require formal credit underwriting and approval.

Recent Closings

Propel Your Practice to the Next Level With Synchronized M&A Solutions

Listing

The Advisory Practice Board of Exchange (APBOE) is a financial advisor marketplace to buy and sell wealth management practices. APBOE provides complimentary listing services for RIA sellers and buyers to engage in M&A activity.

Investment Banking

SkyView Investment Bank specializes in providing independent advisory firms and RIAs with investment banking services. Our team of industry experts focuses on sell-side representation for firms seeking a buyer or an equity partner.

Loans

SkyView has facilitated over $1 billion in RIA M&A financing since inception. SkyView’s credit team works in conjunction with buyers, sellers, investment bankers, and RIA lenders to present financing applications to the banks best suited to fund your M&A transaction.