Financial Advisor Loans

Get Pre-Approved(Within 48 hours) RIA Market Value EstimatorSkyView serves as a trusted advisor to growth-oriented RIAs and independent advisors seeking financing.

Wealth Management Loans

Financing solutions exclusively for financial advisors.

SkyView focuses on providing guidance and financing solutions exclusively for independent and registered investment advisors (RIAs) looking to grow their practices.

Through our SkyLender Marketplace®, we partner with over 25 regional and community banks nationwide that actively lend to advisory firms. Our Credit Team understands the credit policies of all of our bank partners and will facilitate a partnership with the bank best suited to finance your transaction, delivering competitive rates, terms, and conditions.

Your growth initiatives require customized financing solutions. We’re here to help.

Transactions We Finance

- Acquisitions & mergers

- Internal successions & partner buy-ins

- Debt restructures

- Working capital for growth

- Dividend recapitalization

- Wirehouse breakaways

Loan Structure

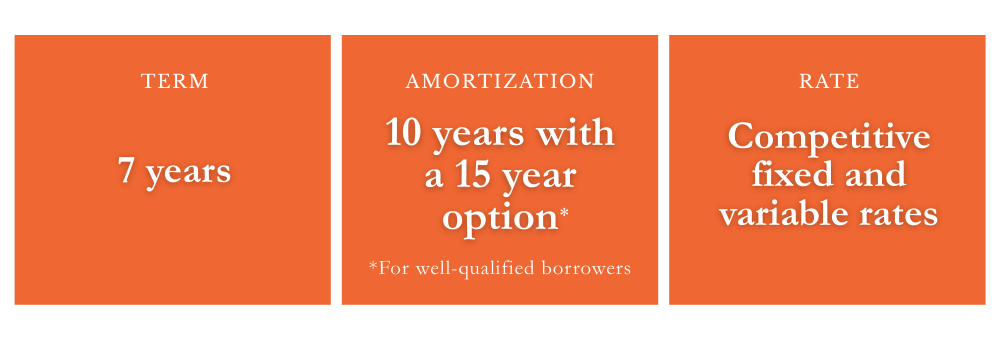

SkyView’s standard conventional loan structure*

SkyView secures conventional bank financing for financial advisor loans rather than SBA loans required for industries and applicants with less financial veracity. Average loan terms include the following:

* This does not constitute a commitment to lend. The fee, rate, terms, and conditions are for informational purposes only and will require formal credit underwriting and approval.

Loan Types

Conventional vs. SBA loans for RIAs.

Advisor loans can be financed through a conventional or SBA loan structure. A significant majority of SkyView borrowers retain conventional financing (non-SBA); however, our Team will help you determine the best loan structure for your transaction.

Estimate how much you could qualify for with conventional financing

A Borrower-First Approach

Why financial advisors choose SkyView

SkyView is dedicated to delivering tailored financing solutions for independent and registered investment advisors, backed by extensive industry knowledge and expertise. We advise financial advisors on both M&A and financing, offering bespoke solutions from a myriad of bank partners.

ADVISOR-FOCUSED EXPERTISE

We work exclusively with financial advisors and have funded over $1.2B+ in advisor loans across 500+ transactions. Our clients receive financing advice from a Team that understands the nuances of your wealth management practice.

BORROWER ADVOCACY & SUPPORT

Your dedicated Relationship Manager advocates on your behalf, negotiating terms, managing timelines, and keeping your deal on track throughout the entire process.

IN-HOUSE UNDERWRITING & CLOSING

Our Credit Team collaborates directly with you to build a deal structure accommodative to bank financing and works directly with lenders to communicate the veracity of your financing request, resulting in a more efficient loan origination to close timeline.

MULTIPLE LENDING INSTITUTIONS

Our SkyLender Marketplace® allows lenders to compete or collaborate on advisor financing requests, ultimately pairing the best bank for each borrower’s unique financing request.

FLEXIBLE LOAN SOLUTIONS

Access to 100% bank financing, zero out-of-pocket expenses, longer repayment periods, and lower monthly payments.

Our Process

The SkyView financing process.

Whether you're planning an acquisition, succession, or advisor loan refinance, our loan process is designed to be clear, efficient, and easy to understand, from Pre-Approval through funding.

Pre-approval

Submit our no-obligation pre-approval questionnaire. Our Credit Team reviews your information and responds within Over 150 documents required to close.

Intake call & initial document collection

Relationship Manager and Underwriter work with advisors to understand the proposed transaction. Subsequently, our Team provides a document request list that’s seamlessly uploaded to our secure VDR.

Term sheet execution

In conjunction with our Team, draft a term sheet of rate, term and conditions requested by the advisor and proceed to signing the term sheet outlining the proposed loan terms.

Bank partner selection

SkyView presents your opportunity to our network of bank partners and pairs you with the lender best aligned to fund your current loan and well-aligned with your future M&A needs.

Closing document collection

Receive the capital you need to grow your practice along with a bank partner to propel your practice to the next level in the future.

Closing & funding

Receive the capital you need to grow your practice along with a bank partner to propel your practice to the next level in the future.

Post-Closing Support: Our Team remains available after closing, ensuring you have a long-term partner for your ongoing success and growth initiatives. We are readily available to meet our borrowers’ unique needs at any time.

Ready to propel your practice to the next level?

SkyView can help you secure financing that is aligned with your long-term goals. Get started today.